The Health Consumer Alliance can help you access health care after the COVID-19 emergency ends in 2023. Please read below for details about your rights. Call our toll-free hotline at 888‑804‑3536 (TTY 877‑735‑2929) for a free, confidential consultation.

- Keeping Medi-Cal After the COVID Emergency

- Coverage for COVID Testing, Vaccines & Treatment

- Expiration of COVID-19 Uninsured Group Program

- Tools for Advocates and Assisters

Note: For information about the special rules during the COVID emergency before 2023, check out our archived COVID page here.

Keeping Medi-Cal After the COVID Emergency

Medi-Cal renewals are back! They had been on hold since March 2020.

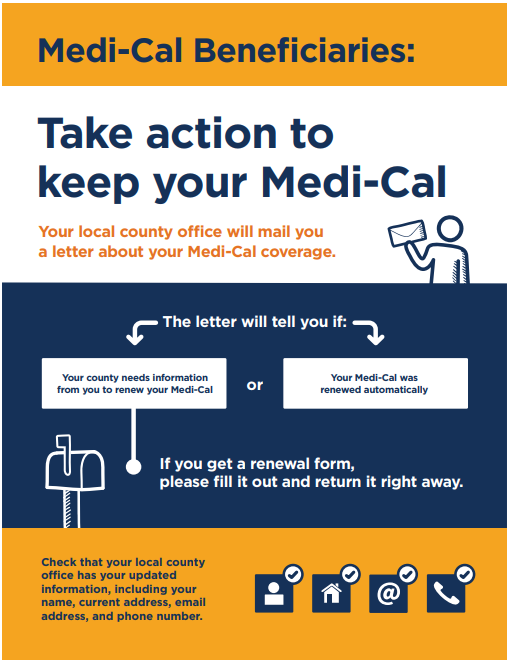

Starting with renewals due in June 2023, counties are processing Medi-Cal eligibility again. You may need to take action today to keep your Medi-Cal. Here are some suggestions:

- Did your address, phone number, or email address change in the past three years? Report any contact information changes to your county.

- Sign up for an account at BenefitsCal.com – video instructions here. Then you will get email and text alerts when your renewal is due. You can also complete your renewal online. Watch a how-to video here.

- Sign up for free renewal info. and reminders at KeepMediCalCoverage.org / MantengaSuMediCal.org.

- Check your mail for a Medi-Cal renewal packet arriving in a new yellow envelope! Return the info. promptly so the county has plenty of time to process it.

- Watch your phone, email and mail for any other requests from your county. Respond quickly with what they need to process your renewal.

- Ask your county to accept your renewal information by phone. New rules allow them to accept your “sworn statement” and income information by phone, if you cannot turn in paperwork in time. Find your county’s phone number here.

- Did you receive a Notice of Action that your Medi-Cal will end? To keep your coverage, request a Fair Hearing before the end of the month. Medi-Cal must stay active until your hearing is resolved.

- If you have SSI – you can get and keep your Medi-Cal by qualifying for SSI and completing your SSI redetermination. Report updated contact information to the Social Security Administration by calling (800) 772-1213 or visiting your local office.

- If you were or are pregnant – tell the county about your pregnancy (no matter how it ended). This will help you keep Medi-Cal for one full year after your pregnancy ends.

Need help with your annual renewal? Or having trouble contacting your county? Contact the Health Consumer Alliance for a free, confidential consultation at 888‑804‑3536 (TTY 877‑735‑2929).

Special Rules for Young Adults Turning Age 26

Adults under age 26 today without immigration status have full-scope Medi-Cal. When they turned 26 during COVID, Medi-Cal protections did not allow counties to discontinue full-scope eligibility. Fortunately, Medi-Cal will expand to cover all ages regardless of immigration status starting on January 1, 2024.

To help young adults turning 26 during COVID to keep their full-scope Medi-Cal, DHCS is delaying their annual renewals to January 2024 and later — when there is no longer an exclusion to full-scope Medi-Cal for people ages 26 to 49. These young adults should plan to renew their full-scope Medi-Cal between January and May 2024.

Medi-Cal No Longer Counts Assets or Property for Renewals

Good news! Starting with Medi-Cal renewals this year, assets and property do not count. Some people who are age 65 and older, or disabled, used to have to keep their assets below a set limit. But not anymore!

Medi-Cal renewals will not count assets anymore. This means you should not have to submit any proofs or information about bank accounts, retirement accounts, property, or any other assets. And you can save money for the future!

Medi-Cal renewal forms and letters may still ask you to report asset and property information. This is because the forms could not be updated in time. People who are age 65 or older, or disabled, do not need to report asset and property information during Medi-Cal renewals. Questions? Contact the Health Consumer Alliance for a free, confidential consultation at 888‑804‑3536 (TTY 877‑735‑2929).

What If I No Longer Qualify For Medi-Cal?

You still have options for affordable health care through Covered California if you no longer meet Medi-Cal requirements. Before your Medi-Cal ends, your case will be sent to Covered California where you will be automatically enrolled into a low cost health plan. This will help you avoid gaps in your health coverage. You can change your health plan if you wish and you can also opt out if you do not want Covered California coverage. If you don’t want to opt-out, make sure to pay your first month’s premium!

To learn more, visit coveredca.com or call 1-800-300-1506.

Protect Yourself From Frauds & Scams

Medi-Cal will never ask you to pay money to renew your coverage! Some fraudsters and scammers are telling people they need to pay fees to keep their Medi-Cal – but they are wrong. Renewing Medi-Cal is always free. And you should only trust information you get from official sources like the Department of Health Care Services, your county Medi-Cal office, and Covered California.

Coverage for COVID Testing, Vaccines & Treatment

Medi-Cal

Medi-Cal still covers testing, vaccines, and medically necessary treatment for COVID. You can get testing, vaccines, and treatment for free! For at-home COVID tests, ask your local pharmacy that accepts Medi-Cal Rx.

Medicare

| Testing | Vaccines | Treatment |

| If you have Original Medicare, testing is also still covered when your health provider orders it. Some Medicare Advantage plans may start to charge cost sharing for testing after May 11, 2023. Medicare will no longer cover at-home COVID tests after May 11, 2023. | Medicare still covers free vaccines. | Medicare will continue to cover (with regular cost sharing) all COVID treatments (including Paxlovid & Lagevrio). |

Private Health Insurance (including Covered California)

| Testing | Vaccines | Treatment |

| Most health plans still must provide at-home and laboratory testing for free–including 8 free at-home COVID tests every month! After November 11, 2023, most health plans may start to charge if you access these tests out of network. (Some plans not regulated by the Department of Managed Health Care may end free testing coverage after May 11, 2023). | Until November 11, 2023, most health plans must continue to cover vaccines for free (even out of network). After November 11, 2023, most plans may start to bill members if they get a vaccine from an out-of-network provider. | Most health plans will continue to cover treatments for free. |

COVID-19 Uninsured Group Program Expires

During the pandemic, the COVID-19 Uninsured Group Program covered over 360,000 people who needed health care related to COVID. It covers testing, vaccines, and treatment of anything else related to COVID for dates of treatment between March 2020 and May 2023.

Starting after May 31, 2023: eligibility will end, and the program will expire! This means it will no longer accept applications, and everybody with coverage will be cut off. Before then (starting March 20, 2023), people will receive a letter that confirms the coverage cutoff and includes an application for full-scope Medi-Cal and Covered California.

To avoid a gap in coverage, apply for regular Medi-Cal or Covered California today! By mail, phone, and online now at Covered California and learn about more coverage options here. The Covered California special enrollment period will last until July 31, 2023 – so apply before then!

Tools for Advocates & Assisters

Posted below are resources for Medi-Cal advocates and assisters organized into two categories: Outreach & Education, and Rights & Rules to Keep Medi-Cal.

Outreach & Education

Help spread the word that renewals are coming back, so people should take action to keep their coverage! Here are several useful resources:

- DHCS’s Outreach Toolkit: call scripts, draft emails, website alert text, printable flyers & posters, social media graphics (like those at right), and more are all available for your use in 19 languages!

- Sign up to be a DHCS Coverage Ambassador: to get the latest alerts and information directly from DHCS.

- Watch our webinar for advocates and assisters (slides here): it covers the mechanics of Medi-Cal renewals and how to help people keep their coverage.

- In February & March 2023, DHCS sent a mailer to all people with Medi-Cal that tells them how to get ready to renew their coverage.

Rights & Rules to Keep Medi-Cal

During the pandemic, the state improved many rights and rules for Medi-Cal eligibility. Below are suggestions on how to make the most of them to help people keep their Medi-Cal.

- Renewal Timeline (Required Notifications)

- Use BenefitsCal to Complete Your Renewal

- State Fair Hearings

- Prove Income by “Self Attestation”

- Prove Income by “Reasonable Explanation”

- Sworn Statements (Affidavits)

- Reasonable Compatibility for Income

- No Proofs Needed for Income at or Below 100% FPL

- No Proofs Needed for Stable Sources of Income (like Social Security)

- No More Asset & Property Limits!

- Renewals for people with SSI

- Renewals for people with CalWORKs

- Renewals for People with CalFresh

- Young Adult Expansion (Up to Age 26) Renewals

- Medicare Savings Program (MSP) Restorations

- Waiver of “Medical Support Enforcement” Rules (for Kids & Parents)

- Resource: Keeping Medi-Cal When Renewals Restart In 2023 webinar video recording

- Resource: Stay Current on DHCS Enrollment & Renewal Data!

Renewal Timeline (Required Notifications)

Everybody with Medi-Cal has the right to renew their coverage with proper notifications from the county, and the opportunity to submit their renewals. Below is a timeline of the process that must be followed for a typical renewal. If any of the steps are missed, the Medi-Cal beneficiary has a right to keep their coverage active until the county completes each step. A visual sequencing map shows the processing period for each renewal month (which can be found in the DHCS Unwinding Operational Plan).

For a renewal due in June 2023:

- Before this renewal is due in June: The beneficiary has a right to keep their Medi-Cal eligibility active unless they die, move out of state, or request a voluntary disenrollment. Since March 2020, all renewal information submitted (including change reports) were only processed if they resulted in a positive action, like lowering a share of cost or moving to full-scope eligibility. Counties never stopped sending annual renewal forms during the pandemic. But any information reported earlier (including renewals in 2020, 2021, and 2022) that would have normally resulted in a negative action will not be processed. All that matters now is that the beneficiary report current information for the renewal due in June 2023.

- April 7: The county must attempt to renew Medi-Cal automatically (ex parte) by looking to all of the information it already has on file. If Medi-Cal is renewed automatically, the county must send a letter saying coverage has been renewed for another year. That beneficiary’s renewal is complete.

- April 19: If Medi-Cal is not renewed automatically, the county must mail a renewal packet (forms MC 210 RV, MC 216, and MC 217 in threshold languages with this special insert in English/Spanish). To avoid a Medi-Cal cutoff, the beneficiary must return the requested information before the end of their renewal due month. They can turn in the information by phone, internet, mail or in person.

- May 15: If the county has not received the beneficiary’s renewal information, it must mail a reminder notification.

- June 2: If the county has not received the beneficiary’s renewal information, it must send a second reminder. Counties can call, email, or text beneficiaries. Most counties will probably send the same reminder notification a second time.

- June 20: If the county has not received the beneficiary’s renewal information, it must send a notification terminating Medi-Cal.

- July 1: If the county has not received the beneficiary’s renewal information, Medi-Cal ends on this date (the day after the renewal due month).

- Until the end of September: For 90 days after the Medi-Cal cutoff, the beneficiary can provide information needed to renew. The county must accept the information and promptly process the renewal. If Medi-Cal can be renewed, it restores eligibility back to July 1.

Case Example

Rebeca received her annual renewal forms in August 2020, August 2021, and August 2022. In her 2020 renewal, she reported that she had lost her job at Target. Then in her August 2021 renewal, she reported that she started working for Amazon. With her August 2022 renewal, she reported she had quit Amazon and was working for the local school district at an income three times as high as her Target income.

Even though Rebeca was likely over income for Medi-Cal in August 2022, the county should not have processed her renewal because it would have ended her coverage. With her August 2023 renewal, Rebeca should report her job and income at that time. If it is still too high for Medi-Cal, the county should transfer her to Covered California for continued coverage.

Renewals are spread out over the year, so not everybody has their renewal due in the same month. You can adjust the timeline above to match the specific renewal “due month” for any person. Most people will renew during their regular annual renewal month, but some people may renew earlier when:

- A young adult without immigration status turned age 26 since March 2020 (details here); or

- The county processes somebody’s CalFresh recertification, they can also process the Medi-Cal renewal (see county questions, topic B); or

- The county receives a reported change in circumstance that results in a positive change, then they would complete a full Medi-Cal renewal even if it means a negative action for another member of the household (see ACWDL 22-18 page 9, county questions, topic C);

- During COVID, DHCS took action in the state database (MEDS) to keep Medi-Cal active because the county computer system (CalSAWS) erroneously assessed a share of cost (SOC) or erroneously terminated coverage (ACWDL 22-18 pages 11-12); or

- The person lost SSI eligibility, so the county must evaluate them for all types of Medi-Cal.

Use BenefitsCal to Complete Your Renewal

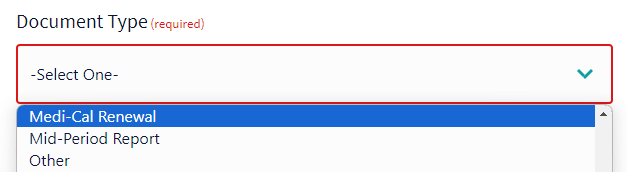

BenefitsCal.com is the new statewide website that you can use to manage your Medi-Cal eligibility. After you sign up for a free account, you can complete your annual renewal directly at BenefitsCal.com. You can also upload a scanned copy of your renewal form by logging into BenefitsCal, or without a login at this link. Be sure to select “Medi-Cal Renewal” as your “Document Type” when you upload a document.

State Fair Hearings

When people disagree with a Medi-Cal eligibility decision, they can request a Fair Hearing. Normally, the deadline to request the hearing is 90 days after they receive a notice of action. Until September 2024, the deadline is 120 days after they receive a notice of action.

Prove Income by “Self Attestation”

Instead of submitting paystubs or other proofs of your income, you can simply tell the county what your income is. They call this a “self attestation.” You can simply write your income on your renewal form, and then sign it and turn it in. You can also tell the county your income when you do your renewal online, or by phone. Then the county must accept this “attestation” as proof of your income, and not ask for paystubs or other proofs. This special rule started on October 1, 2023.

Prove Income by “Reasonable Explanation”

When an automatic renewal is not possible, it’s likely because electronic data showed that a beneficiary’s income was too high. When this happens, a beneficiary can simply provide a “reasonable explanation” of their actual income.

What is a “reasonable explanation”? It can be anything that explains why the beneficiary’s actual income is correct, and the higher electronically-reported income is not. For example:

- “I lost my job”

- “My hours went down”

- “It was seasonal income”

- “My income changes monthly”

- “My wages were only high because I get paid by commission”

- “I got married / divorced”

- “I am a victim of identity theft / natural disaster”

- “I am a survivor of domestic violence”

- “I am homeless”

- “I do not file taxes or haven’t filed yet”

Beneficiaries can submit their reasonable explanations by phone, mail, internet, and in person. Counties must accept these explanations instead of asking for other income proofs. Explanations can be verbal and do not need to be signed under penalty of perjury. An optional form can be used. Counties must accept any reasonable explanation that “resolves or explains the income discrepancy.”

During annual renewal, the county must offer the option to provide a reasonable explanation by phone and by adding instructions to any mailed requests for verification. If somebody is not provided this basic information about reasonable explanations, they can ask the county to accept it anyway.

Note: Current state policy (topic F.5.) excludes people who do not have social security numbers (SSN) and does not allow them to provide reasonable explanations. But counties should have ways to check electronic data even for people without SSNs, so you should ask them to accept reasonable explanations.

Case Example

Rebeca submits her annual renewal with her Social Security award letter showing her $1,500 income. For two months in the summer of 2022, Rebeca had approximately $2,000 in temporary income with the YMCA but did not have paystubs to send to the county. When the county reviews the electronically reported income, it sees the YMCA earned income. The county should call Rebeca and request a reasonable explanation. Rebeca can simply explain that her YMCA income was temporary and her Social Security is her only current income. The county must then consider her income verified, and request no further income proofs.

Sworn Statements (Affidavits)

Instead of turning in proofs, beneficiaries can submit sworn statements (affidavits) to prove all eligibility criteria except for social security number (if reported) and immigration status. (22 CCR § 50167 and DHCS MEPM Section 4M). In 2021, DHCS clarified that counties must accept sworn statements online and by phone during application and renewal.

Counties may not offer the sworn statement option. Or they might not accept it when you try. You can remind counties that you need to submit the sworn statement because you have no way to get any other proof. Then the county must accept it as sufficient.

Case Example

The county asks Rebeca to submit proof that her temporary YMCA job ended in summer 2022. Rebeca has only two weeks until her renewal month ends, and she cannot get in touch with the YMCA in time. She tried calling twice, and the YMCA could not help her get a letter. Because Rebeca has no other way to get the proof, the county must accept her sworn statement that her job ended in summer 2022.

Reasonable Compatibility for Income

Under reasonable compatibility rules, Medi-Cal can automatically verify income even when electronic data shows that income is above Medi-Cal’s income limits. Income will auto-verify when a beneficiary attests that their income is below Medi-Cal’s limits, and electronic data shows income is below 20% higher than Medi-Cal’s limits.

For example, 20% higher than 138% FPL is 165.6% FPL. That means if a beneficiary’s case file already shows income below 138% FPL, the electronic data can show income up to 165.6% and the income will auto verify! Note we will rarely know that these rules were used or not used for a renewal since it happens automatically in the county’s computer system. If you think the county did not properly apply these rules, you can ask for them to use them or prove to you that they did.

Note: These 20% reasonable compatibility rules will help more people auto-verify their income until May 2024. After then, DHCS proposes to reduce it to 10%.

Important: DHCS declined to adopt these beneficiary-friendly rules for aged and disabled people with non-MAGI Medi-Cal.

No Proofs Needed for Income at or Below 100% FPL

People with income at or below 100% federal poverty level (FPL) should not have to prove their income. For all renewals through May 2024, DHCS has special rules that allow people to auto-verify their income at or below 100% FPL when (1) their last renewal or application verified their income, (2) electronic data do not include income information, and (3) there is no conflicting case information about income.

This means that people will still be mailed Medi-Cal renewal packets and will need to attest that they still have income at or below 100% FPL. Then, counties manually check to make sure there is no conflicting case information (like an earlier report of income). If there is no conflict, then counties must auto-verify the income without requesting further proofs.

TIP: For anybody at or below 100% FPL who is asked for income proofs – first ask the county if it can auto-verify the income (instead of needing proof).

No Proofs Needed for Stable Sources of Income (like Social Security)

Starting August 1, 2023, people who have only stable sources of income do not need to prove or report their income during their annual renewals through May 2024.

This means that counties should automatically verify (without asking for information or proofs) all stable sources of income, including: Social Security, pensions, retirement income (annuities, deferred compensation), disability payments (worker’s compensation and private sources), alimony, child support, and fixed distributions of dividends/interest and annuities.

People still need to report and prove non-stable sources of income, like employment income.

TIP: For anybody with a stable source of income (full list above), counties should not ask for information or proof of that income. If a renewal is not being processed because of a missing proof of a stable income source, ask the county to auto-verify the income under this “stable sources of income waiver.”

No More Asset & Property Limits!

Until the Medi-Cal asset limits are eliminated in January 2024, counties must renew non-MAGI Medi-Cal eligibility without requesting updated asset and property information. Counties must look at the asset and property information already in the case file and disregard any asset changes since the last Medi-Cal eligibility determination. This means that counties should not request any asset information or proofs during annual and change-in-circumstance renewals, including moves from MAGI to non-MAGI, and into Long-Term Care (LTC) (see county questions, section J).

There are only three exceptions when counties may ask for asset information:

- For new applications (not renewals), the increased asset limits still apply until January 2024.

- For net income from property (22 C.C.R. § 50508), people may need to report information about any real property they own and any net income. Note this only means the countable income (not property value) may be considered.

- The county may request asset information to process an application for new household members reported during renewal, when those household members seek non-MAGI Medi-Cal eligibility.

People can complete their renewals without reporting any asset information, except in the three situations above. That means they can leave the property sections blank. Starting in June 2023, DHCS is mailing this flyer to all Medi-Cal households (as part of the regularly quarterly mailings). It says: “No need to send proof of non-income assets or property such as bank statements and car registrations.”

Case Example – Rebeca

Rebeca has a $1,500 Wells Fargo checking account in her Medi-Cal case file from her last renewal completed in 2019. Rebeca submits her renewal information, with a new $3,000 Chase checking account.

The county must verify Rebeca’s assets automatically without requesting any information or proofs. They must look only at the $1,500 Wells Fargo checking account already in the file. The county cannot even ask for information about the Chase account. Rebeca’s renewal should be approved, assuming she meets all other eligibility requirements!

Case Example – Renato

Renato has a $1,500 Bank of America checking account in his Medi-Cal case file from his last renewal completed in August 2019. When Renato submits his renewal information in August 2023, he reports the same checking account. Then in November 2023, Renato reports a change: a new $1,000 savings account.

For both the August 2023 annual renewal and the November 2023 change-in-circumstances renewal, the county must verify Renato’s assets automatically without requesting any information or proofs. They must look only at the $1,500 Bank of America checking account already in the file. The county cannot even ask for information about the savings account. Renato’s renewals should be approved, assuming he meets all other eligibility requirements!

Renewals for People with SSI

People who have SSI (Supplemental Security Income) get Medi-Cal automatically. They do not follow the same renewal rules as people who have only Medi-Cal. But when a person loses their SSI, they must be evaluated for all other Medi-Cal eligibility categories. During COVID, people losing SSI were placed in a special “hold” status. Counties must reevaluate those people for other Medi-Cal eligibility starting in April 2023. Counties may complete these reevaluations any time before June 2024.

Renewals for People with CalWORKs

People who receive CalWORKs have Medi-Cal automatically, as long as they remain eligible for CalWORKs. To keep their Medi-Cal and CalWORKs, people complete CalWORKs semi-annual reports (not the regular Medi-Cal renewals described on this page).

When CalWORKs eligibility ends, some people have the right to keep Medi-Cal coverage for up to one year. Transitional Medi-Cal (TMC) is available to parents, caretaker relatives, pregnant people, and children who are enrolled in either MAGI or CalWORKs-linked aid codes. It’s only available when CalWORKs ends due to increased employment income, loss of earned income disregards, or increased employment hours.

Renewals for People with CalFresh

People who turn in their CalFresh semi-annual reports (SAR 7) can get their Medi-Cal renewed without taking any further action (see county questions, topic B). Counties may use the information in the SAR 7 to renew Medi-Cal for another 12 months, even if that happens before the person’s annual renewal date. Counties can only use the CalFresh SAR 7 to continue Medi-Cal eligibility. They cannot use it to discontinue Medi-Cal, assess a share of cost, or increase a share of cost amount.

Young Adult Expansion (Up to Age 26) Renewals

Young adults turning 26 during COVID will have their Medi-Cal renewals delayed to 2024 so they can keep their full-scope Medi-Cal under the age 26-49 expansion. For young adults with any non-MAGI person in their household, they will renew in January 2024. For all other young adults, they will renew between February and May 2024.

Medicare Savings Program (MSP) Restorations

During the pandemic, federal law required people to keep their Medicare Savings Program (MSP) eligibility, including Qualified Medicare Beneficiary (QMB) status. But some people may have been erroneously downgraded from QMB to SLMB or QI. In February 2023, DHCS told counties to restore all original MSP eligibility. This includes retroactive restorations back to March 2020. If you are owed a reimbursement, this may take several weeks, but it will be reimbursed to you in the same way you receive your usual SSA payment. Medicare premium refunds do not count as income for Medi-Cal eligibility. DHCS is sending mailers to all people who are impacted.

Waiver of “Medical Support Enforcement” Rules (for Kids & Parents)

To get and keep Medi-Cal, most children are required to report and identify their parents. This allows counties and the state to investigate whether any parent can provide health coverage (medical support enforcement). This allows Medi-Cal to be a secondary payor. Normally this creates a paperwork burden on applicants and beneficiaries. From August 1 through May 2024, these rules are suspended. This means that during renewals and applications, people should not be required to report and identify parents for “medical support enforcement” reasons.

Resource: Keeping Medi-Cal When Renewals Restart In 2023 by the National Health Law Program and Western Center on Law & Poverty!

Stay Current on DHCS Enrollment & Renewal Data!

DHCS has published static data slides for the months of March through May 2023 and an interactive data dashboard from June 2023 going forward. Stay up to date on unwinding data on the DHCS Medi-Cal Enrollment and Renewal Data page.